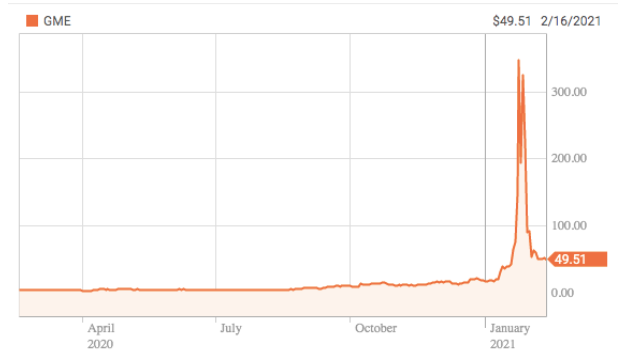

GameStop’s Stock Surge

Art/Photo by Reuters.com

An image describing the shift in GME’s stock values over the course of recent history. The values rose dramatically at around the end of December and beginning of January, and peaked at $483. The values then dropped to where they are now, at $49.51.

February 26, 2021

When asking a rich person for their secret to success, some might say that they invested in the stock market. The stock market, where investors might buy and sell stocks, are shares of ownership in public companies.

Recently, GameStop’s stocks increased dramatically, which caused quite the buzz around the stock community, and the internet in general. The increase was because bands of stock traders on Reddit, a social media site, pushed GameStop’s (GME, GameStop’s name in stock terms) stocks. However, the hedge funds (A hedge fund uses several investment techniques and invests in a wide assortment of assets in order to generate a higher return for a certain level of risk than what is normally expected of investments; it reduces risk when investing) bet that GameStop’s stocks would crash because of poor performance. This meant that the hedge funds would lose an increasing amount of money because of the bets from Redditors’.Thus, the price of the company’s stocks increased from $18.84 to $483 from between the end of December and the end of January. This also resulted in normal investors gaining a huge sum of money. However, Robinhood, a stock trading app, tried to limit the amount of transactions people could make with GME and other companies, which led to a lot of backlash.

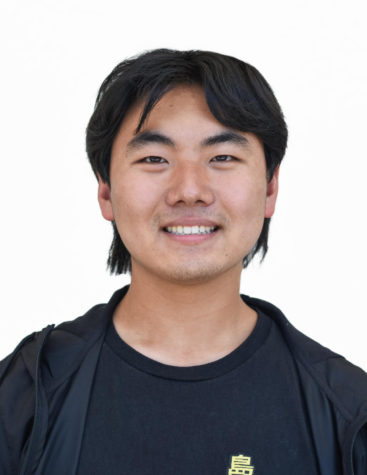

Benjamin Choi (10), someone who understands the stock market and its effects, expressed that “The events were unprecedented for the stock market, and unlike previous short squeezes, Robinhood chose to end trading for GME and AMC.” A short squeeze happens when a stock is often shorted, or borrowed with the expectation of a drop. If a heavily shorted stock increases in value, the people who borrowed stock still need to buy them back, meaning the price will go up.

Even though short squeezes have occurred in the past, there have been no regulations made for them. Choi thought that “it was unfair that people with more power and wealth were inclined to stop people from making a profit.” He went on to explain that “The brokerages who took part in preventing these trades should be punished for their actions, and I hope the stock market will be available to anyone instead of only being accessible to the rich.” Others share this sentiment as well, that the actions taken by Robinhood explicitly favored the rich.

Jordan Au (10) is one such person. He expressed his thoughts about how “Robinhood played to the wrong people and should’ve let things go on.” He expressed similar concerns and disappointment about Robinhood’s decision to favor the richer population over normal investors, that he’s upset “because they [wealthy people] tell ordinary people to invest but when they do, they get [greedy].” A lot of people became really upset at richer peoples’ attempts to hoard money when others have a chance to get some.

Overall, the most discourse about the GME stock events have been about the unexpected nature of the increase in stocks, the response from more affluent communities, and the response elicited from Robinhood, a popular and intuitive stock trading app.